RYAN D. LEE

Helping You Break Free from the Financial System Rigged Against You.

RYAN D. LEE

Helping You Break Free from the Financial System Rigged Against You.

Ready To Achieve Financial Success?

Take control over your future and start living your best life today! Stop saying "One Day" and Start Saying Today!

Start Your Journey

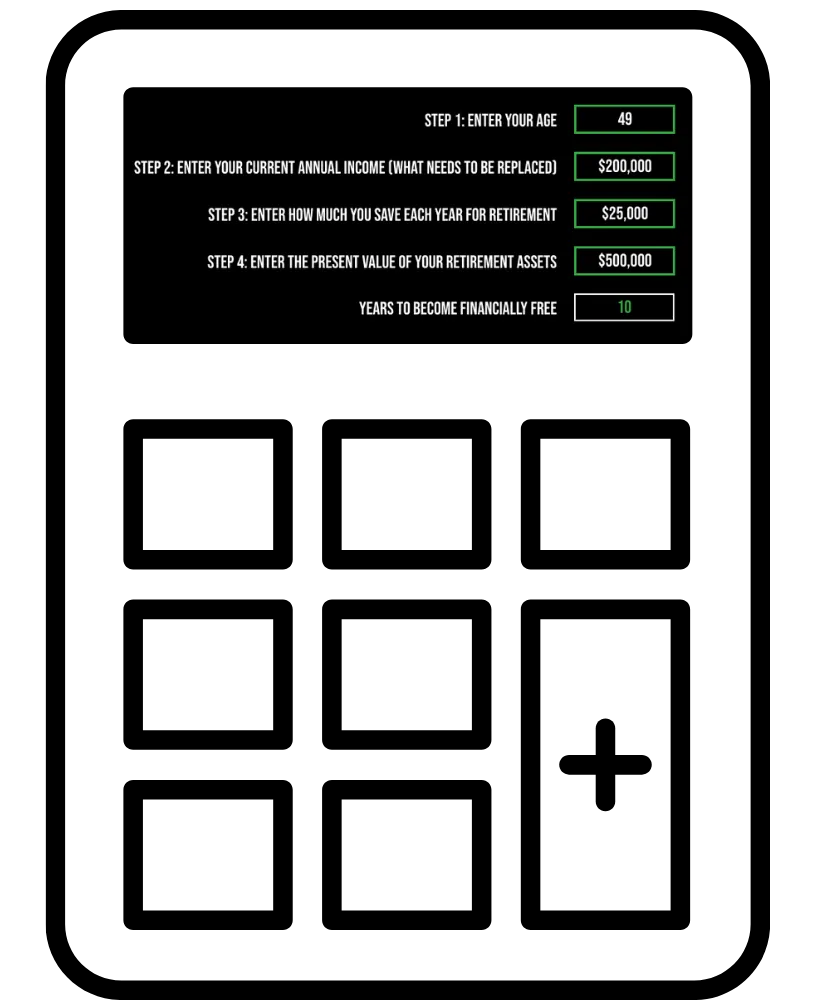

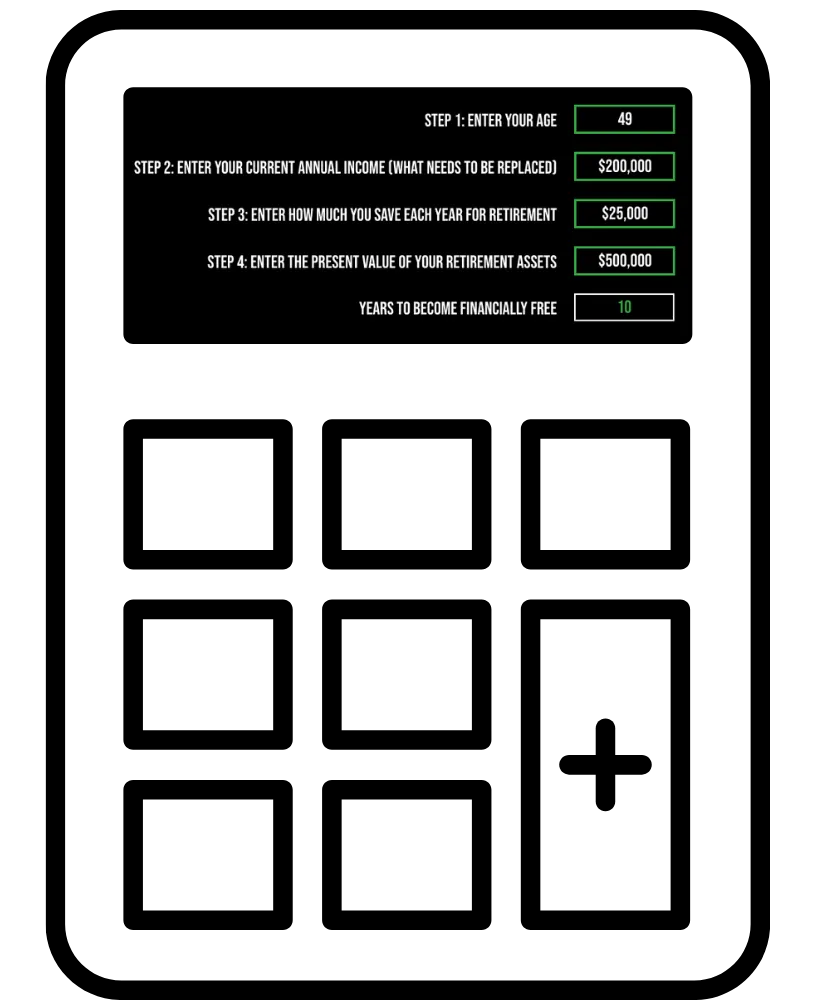

Calculate Your Retirement Health

Passive Income Machine Podcast

Wealth Outside Wall Street Youtube Channel

Use 4 Simple Numbers To Calculate Your Retirement Health

Learn The Secrets Of Financial Freedom Inside Ryan's Podcast

Understand how to be in the driver seat of your financial future

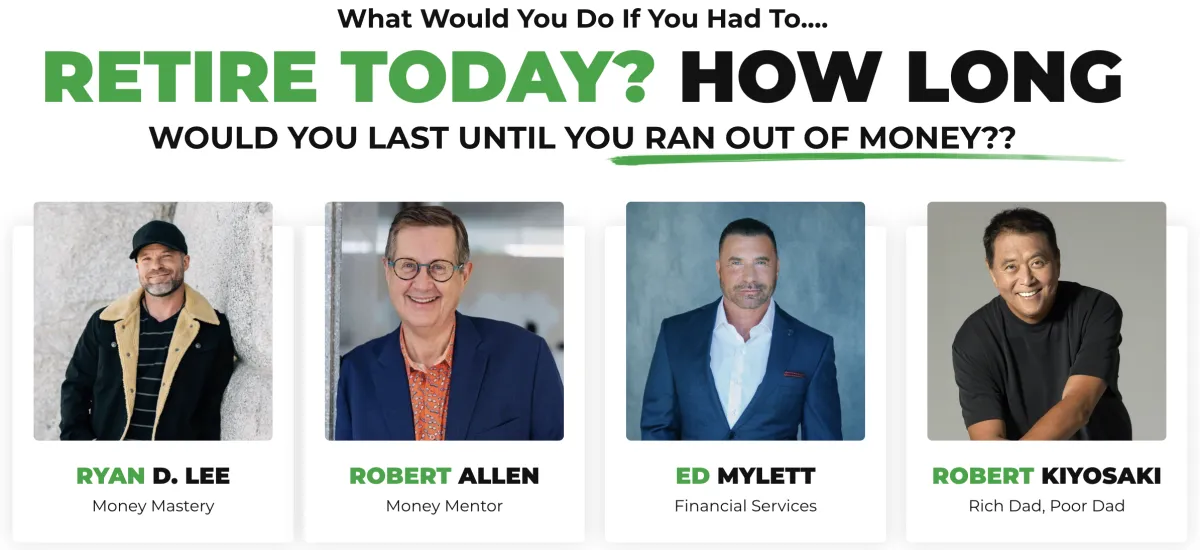

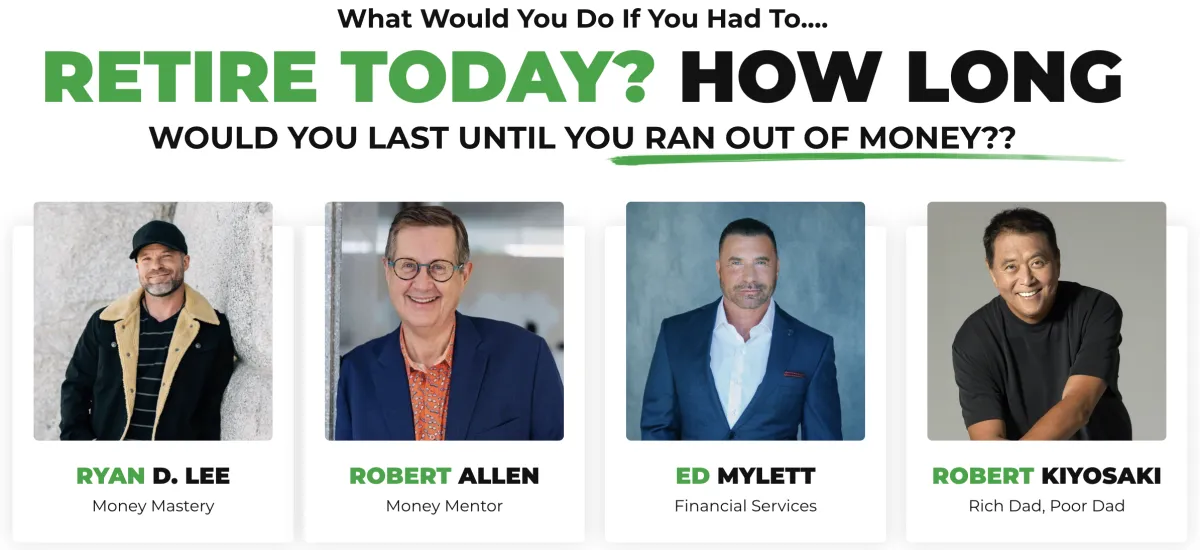

JOIN THE RETIRE IN 10 YEARS OR LESS SUMMIT

Come learn from some of the biggest names in the financial spaces as they bring together the best of the best ideas, strategies, tips, and ways to achieve financial freedom and retire in 10 years or less...

Start Your Journey

Calculate Your Retirement Health

Use 4 Simple Numbers To Calculate Your Retirement Health

Passive Income Machine Podcast

Learn The Secrets Of Financial Freedom Inside Ryan's Podcast

Wealth Outside Wall Street Youtube Channel

Understand how to be in the driver seat of your financial future

JOIN THE RETIRE I N 10 YEARS OR LESS SUMMIT

Come learn from some of the biggest names in the financial spaces as they bring together the best of the best ideas, strategies, tips, and ways to achieve financial freedom and retire in 10 years or less...

RYAN D. LEE

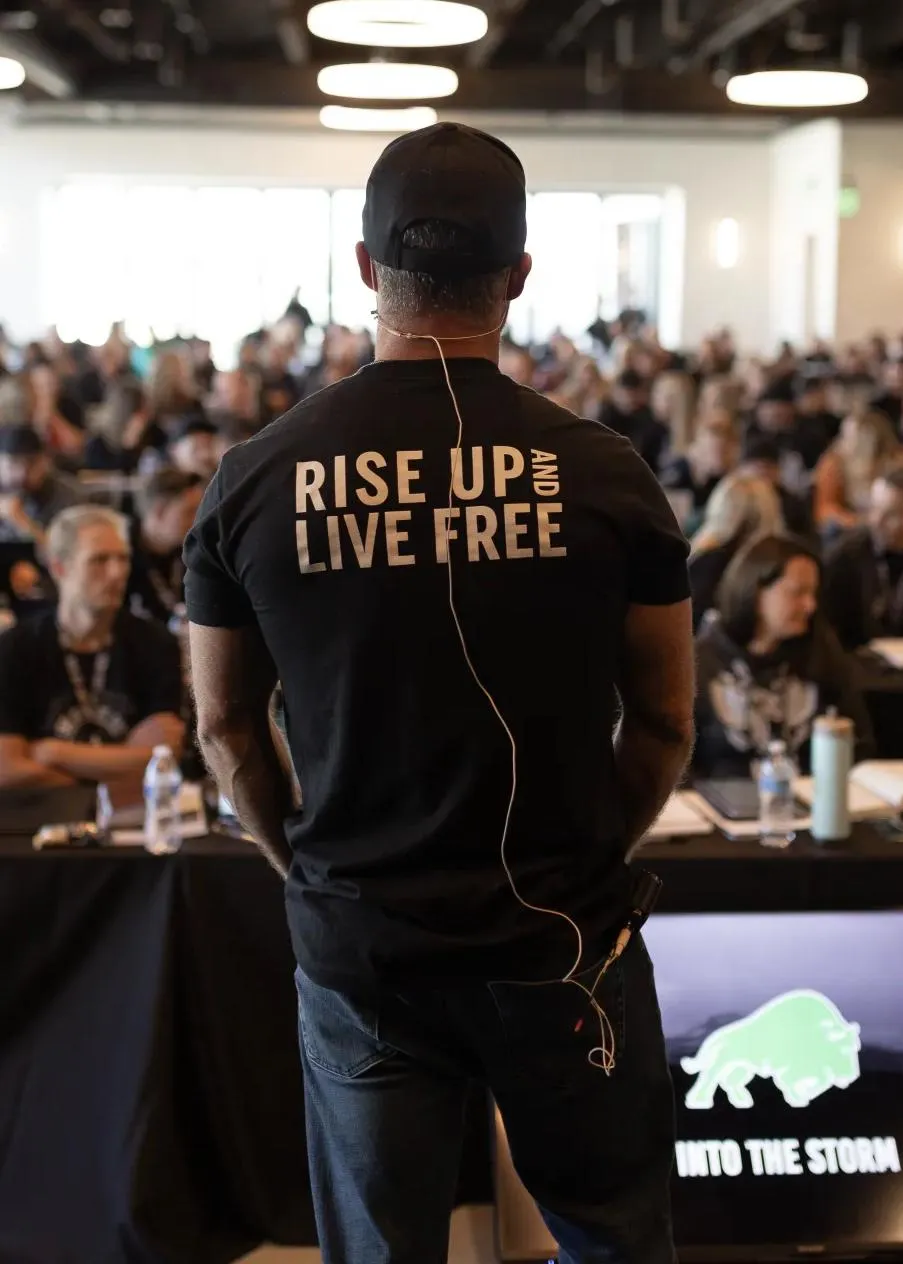

Ryan is a foremost speaker, educator, and trainer in the market, dedicated to assisting individuals in cultivating Money Mastery through learning and applying timeless financial principles. His mission is to empower people with the means to construct and embrace a life worth living, all while attaining financial freedom in a 10 years or less.

See Ryan Speak From Stage

Watch Ryan's Speech From Funnel Hacking Live 2023 In Front Of 5,000+ Individuals

See Ryan Speak From Stage

Watch Ryan's Speech From Funnel Hacking Live 2023 In Front Of 5,000+ Individuals

Want To Book Ryan To Speak?

Complete This Form and Our Team Will Reach Out To You Directly

COMPANY'S

LEGAL

FOLLOW RYAN D. LEE

DISCLAIMER: Ryan D. Lee is an educational speaker. Ryan D. Lee is not selling investments, insurance, real estate, securities, or anything other than education and is not providing tax advice, legal advice, or investment advisory products. He discusses general principles and strategies, but He does not know anything about you or your financial circumstances. As you consider applying the educational principles and strategies you see here, you should understand that there is risk in any investment and Ryan D. Lee cannot guarantee any particular results or success.